Refinancing your property personal loan can be one of many smartest financial techniques you make because a homeowner. Along with interest rates fluctuating and market situations shifting, the chance to unlock personal savings on your home loan is often just a decision away. Whether you're seeking to reduce the monthly obligations, access equity for renovations, or consolidate debt, knowing the refinancing procedure is crucial in maximizing the positive aspects.

Because you consider carefully your options, it is essential to familiarize yourself with the particular ins and outs of refinancing house loans. From assessing your current finances to comparing diverse lenders, making informed choices can prospect to significant long term savings. In this particular manual, we will discover key strategies and even insights to assist you navigate the particular world of replacing effectively, ensuring an individual make one of the most associated with your home's financial potential.

Understanding Home Bank loan Refinancing

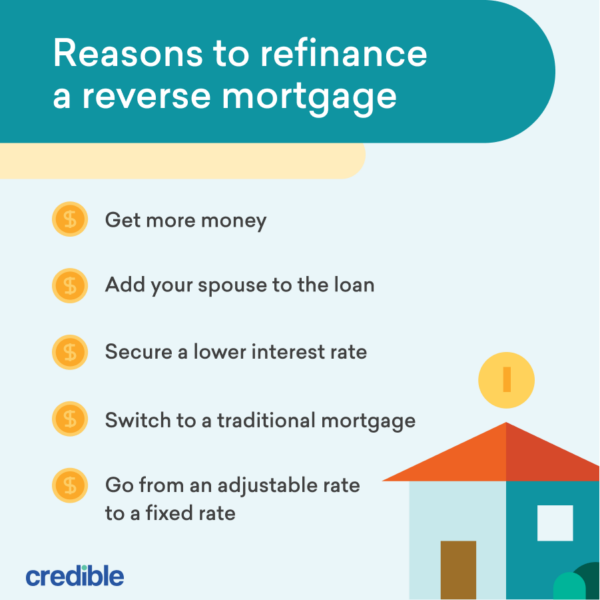

House loan refinancing is usually the procedure for changing your existing mortgage with a new one, typically to secure better words. This can consist of lower interest prices, reduced monthly obligations, or even altering the duration regarding the money. Homeowners frequently consider refinancing since a strategy to save money over the living of the bank loan or access further funds for various other financial needs.

One involving the key great things about refinancing is the particular prospect of significant cost savings. If interest rates have dipped since you took out the original mortgage, re-financing could lower the monthly installments. Additionally, this might help you change from an adjustable-rate mortgage to some sort of fixed-rate mortgage with regard to more predictable potential future payments.

Another important basis for refinancing is in order to utilize your home's equity. Homeowners may possibly elect to refinance to be able to take cash-out, which usually can then supply for home improvements, debt consolidation, or other costs. However, it is definitely essential to assess the costs associated with refinancing, because they can offset the potential personal savings if not cautiously considered.

Benefits of Re-financing Your property Loan

Refinancing the home loan can lead to important financial benefits. One particular of the most immediate advantages is the prospect of decrease interest rates. When market conditions change or your credit rating score improves, an individual might qualify for a reduced rate as compared to what you might initially secured. This reduction may substantially lower your regular payments, allowing you to spend less more than the term from the loan and clearing up cash intended for other expenses or investments.

Another benefit associated with refinancing is the opportunity to change from an adjustable-rate mortgage to some sort of fixed-rate mortgage. Adjustable-rate mortgages typically start with lower rates, but those prices can increase with time, leading to unpredictability in monthly payments. By refinancing to a fixed-rate mortgage, homeowners can strengthen their payments and better plan their budgets, reducing the stress related to fluctuating repayments.

Lastly, refinancing can assist you tap directly into your home’s collateral. If your property price has grown, you may refinance to access a few of that value for home enhancements, consolidation, or other financial needs. This kind of can ultimately boost your financial condition and improve your own lifestyle, making refinancing a smart move for many property owners trying to optimize their finances.

When to Refinance Your Home Bank loan

Deciding any time to refinance your property loan is important for maximizing your savings. One normal reason to take into account refinancing is actually a drop in interest rates. In case current mortgage rates are significantly more affordable than your current rate, refinancing can result in substantial savings in your monthly payments. refinance home loan to review your current price with prevailing markets rates, as even a small difference can certainly yield long-term monetary benefits.

Another key time to refinance will be when your credit score score improves. When you have produced efforts to boost your creditworthiness since initially securing your current loan, you might be eligible for better plus more favorable terms. An increased credit score can create new opportunities to reduced interest rates, which could reduce your general payout and enhance your financial versatility.

Last but not least, refinancing is a strategic move whenever your monetary situation changes, for instance a substantial increase inside income or typically the need to lessen debt. If you find that you may comfortably manage a shorter loan term or even are looking in order to consolidate debts from a lower curiosity rate, refinancing could be the perfect opportunity. These types of considerations can significantly impact your economical health in each the short plus long term.

How to Choose the correct Lender

Any time refinancing your house financial loan, selecting the correct lender is essential to securing the best terms and saving money on the long go. Start by researching multiple lenders to assess their offerings, fascination rates, and charges. Seek out lenders who else focus on refinancing, while they may have customized products that can far better meet your requirements. It’s also beneficial to check evaluations and ratings by other customers to gauge the lender's reputation and customer satisfaction track record.

Next, take into account the forms of financial loans the lender features and whether they align with the financial goals. Several lenders might supply a variety regarding refinancing options, such as fixed-rate or adjustable-rate mortgages, which usually can significantly impact your monthly obligations and overall savings. Additionally, take take note of any potential closing costs plus whether the lender lets you roll these kinds of in to the loan sum. Understanding these particulars will help an individual call and make an informed selection.

Lastly, build relationships potential loan companies to inquire questions and clarify any questions you could have. A great lender will be see-thorugh about their processes and willing to discuss your unique condition to find typically the best solutions intended for you. This communication is essential, while it can in addition give you insight into their responsiveness and willingness to be able to assist you throughout the refinancing procedure. Taking the time to choose the right lender can result in substantial financial savings plus a smoother re-financing experience.

The Refinancing Procedure Described

Refinancing a home loan involves many key steps that may ultimately lead to significant savings. The particular first step is always to assess your existing financial situation and decide your goals for refinancing. This can include evaluating your credit score, current interest prices, and how lengthy you plan in order to stay in your home. Knowing your motivations, whether it’s cutting your payment, changing the loan term, or making use of equity, will guideline your refinancing selection.

After getting a clear strategy, the next step is to go shopping around for lenders. Different lenders may well offer varying words, interest rates, plus closing costs. It’s essential to accumulate multiple quotes plus compare them part by side. Try to find lenders that focus on refinancing, and think about reaching out to your current loan company to see if they can provide you with a better deal. Carrying out thorough research and being diligent will help you find the best refinancing available options.

After choosing a lender, you need to complete the app process. This typically involves providing documentation for instance W-2s, levy returns, and evidence of income, in addition to details about your current loan in addition to property. The lending company will certainly then assess the application and initiate the appraisal if necessary. Once approved, you will get a closing disclosure that sets out the final words, and you’ll check out closing, where you'll sign documents and finalize the refinance. It's an ideal financial move that can lead to more healthy financial management.

Common Errors to Avoid

One frequent mistake homeowners help make when refinancing their house loan is not necessarily research for the best rates. Many individuals assume that their very own current lender may offer them the particular best deal, although this is frequently not the situation. It is essential to compare prices from multiple lenders to ensure you are getting a new deal that really saves you money. Even a little difference in appeal rates can result in important savings above the long term, so investing the time to research can pay away.

One other mistake is looking over the total expenses associated with refinancing. Homeowners may well focus solely around the interest rate but neglect to account regarding fees for example shutting costs, appraisal service fees, and other costs that can add up quickly. It’s crucial to perform a detailed analysis of the costs to identify if the overall cost savings from your lower price outweigh the charges of refinancing. This kind of comprehensive approach helps ensure that the decision is indeed fiscally beneficial.

Lastly, some house owners rush into the particular refinancing process with no considering their long-term financial goals. Refinancing can be a great excellent opportunity to adjust the money phrase or switch through an adjustable-rate mortgage to a fixed-rate mortgage, but these decisions should arrange with your upcoming plans. Take the particular time to examine how refinancing matches your overall economic strategy and assure it supports your objectives, instead of basically reacting to short-term market changes.